Samsung credit agreementcraigslist albuquerque nm – Samsung Credit Agreement Craigslist Albuquerque NM: This phrase immediately raises questions about the intersection of consumer electronics financing, online classifieds, and potential risks. The search query suggests someone is looking for information regarding Samsung financing options, possibly through a less conventional channel. This exploration delves into the implications of this specific search, examining the user’s intent, potential scenarios, and associated risks.

We’ll investigate the Albuquerque Craigslist landscape, explore the legalities of selling credit agreements online, and provide crucial guidance on identifying and avoiding fraudulent offers.

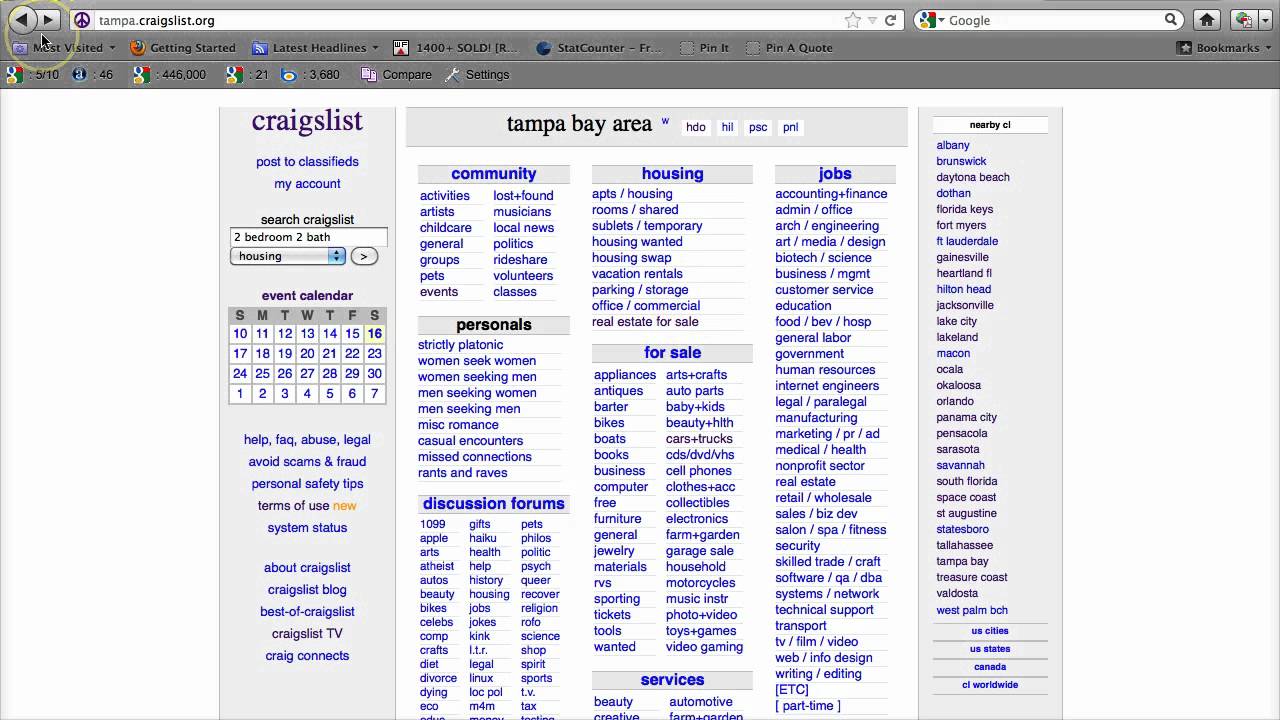

Understanding the context of this search requires examining several factors. Firstly, the use of Craigslist, known for its diverse and often unregulated listings, introduces significant uncertainty. Secondly, the specificity of “Samsung credit agreement” suggests a user actively seeking a specific type of financing, possibly due to a pressing financial need or a pre-existing relationship with Samsung. Finally, the geographic location, Albuquerque, NM, helps to narrow down the scope of the investigation, focusing on the local Craigslist market and relevant legal jurisdictions.

Understanding the Search Term: Samsung Credit Agreementcraigslist Albuquerque Nm

The search term “Samsung credit agreement Craigslist Albuquerque NM” suggests a user seeking information about financing options for Samsung products, specifically through potentially informal channels in Albuquerque, New Mexico. The inclusion of Craigslist indicates a preference for a less formal, peer-to-peer marketplace rather than directly through Samsung or a traditional lender. This raises several implications regarding the user’s intentions and the potential risks involved.The user’s intention behind this search query likely stems from a desire to acquire Samsung products through financing, possibly due to budgetary constraints or a preference for alternative payment methods.

They may be seeking used Samsung devices offered with financing plans arranged between private sellers and buyers on Craigslist, or they may be looking for information on existing credit agreements to understand their terms and conditions. The specificity of the location (Albuquerque, NM) narrows the search to that geographic area.

Possible User Intentions

Someone searching for “Samsung credit agreement Craigslist Albuquerque NM” might be pursuing several different objectives. They could be trying to find a seller offering financing directly, perhaps through a payment plan or a third-party financing option. Alternatively, they might be attempting to resell a Samsung product that came with a credit agreement and need to understand the transferability of the agreement.

Finally, they could be looking for information on how to manage an existing Samsung credit agreement, perhaps needing to make a payment or understand the terms of their contract. The search term doesn’t definitively specify a single intent.

Scenarios Illustrating Search Intent

Several scenarios could lead someone to use this specific search phrase. For instance, a person might find a used Samsung phone on Craigslist in Albuquerque and want to confirm the seller’s financing terms before purchasing. Another scenario could involve someone trying to sell their Samsung TV and needing to understand the terms of their existing financing agreement to properly transfer ownership.

Finally, a user could be experiencing difficulty making payments on a Samsung credit agreement and searching for information or contact details on Craigslist, hoping to find help or clarification.

Potential Risks Associated with the Search

Searching for financing options on Craigslist carries inherent risks. There is a higher chance of encountering fraudulent sellers or individuals offering predatory lending practices compared to established financial institutions. Users might face scams involving fake financing offers or deals that lead to identity theft or financial loss. Furthermore, any agreements made outside of official Samsung channels might lack the consumer protections afforded by traditional credit agreements.

Users should exercise extreme caution and independently verify the legitimacy of any offers found on Craigslist before entering into any financial agreements.

Samsung Credit Agreements

Samsung credit agreements, offered through various financial institutions in partnership with Samsung, allow consumers to finance the purchase of Samsung electronics. These agreements typically involve a fixed monthly payment plan spread over a predetermined period. Understanding the terms and conditions is crucial before signing any such agreement.

Standard Terms and Conditions of Samsung Credit Agreements

Standard terms and conditions in Samsung credit agreements usually include details about the interest rate (often a variable APR), the loan amount, the repayment schedule, and any associated fees. These fees might include late payment fees, early repayment fees, and potentially insurance premiums. The agreement will clearly Artikel the total amount payable over the life of the loan, including interest and fees.

The contract will also specify the consequences of defaulting on payments, which could involve late fees, damage to credit score, and even legal action. Specific terms vary depending on the lender and the chosen repayment plan. It is imperative to carefully read and understand all aspects of the agreement before signing.

Comparison with Other Consumer Credit Options, Samsung credit agreementcraigslist albuquerque nm

Samsung financing options can be compared to other consumer credit options like store credit cards, personal loans, or credit cards. Store credit cards, like those offered by Samsung, often have higher interest rates than general-purpose credit cards but might offer promotional financing periods (e.g., 0% APR for a limited time). Personal loans typically offer lower interest rates than store cards but may involve a more rigorous application process.

General-purpose credit cards offer flexibility in purchases but may have higher interest rates if balances are carried. The best option depends on individual financial circumstances, creditworthiness, and the desired purchase amount. For example, a consumer with excellent credit might secure a lower interest rate personal loan, while someone with limited credit history might opt for a store credit card with a promotional period, even with a potentially higher long-term interest rate.

Identifying Fraudulent Samsung Credit Agreements

Fraudulent Samsung credit agreements often involve deceptive practices aimed at obtaining personal information or financial gain. Red flags include unsolicited emails or phone calls offering credit, unusually low interest rates or easy approval, requests for upfront fees or payments, and agreements that lack transparency or contain inconsistencies. Legitimate Samsung financing will be offered through official channels and will not require payment before the credit is approved.

Always verify the authenticity of any offer by contacting Samsung directly through official channels listed on their website. Suspicious websites or email addresses should be avoided. Furthermore, be wary of offers that seem too good to be true.

Consequences of Entering into a Fraudulent Credit Agreement

Entering into a fraudulent credit agreement can have serious consequences. This could include identity theft, financial loss, damage to credit score, and potential legal repercussions. Fraudulent agreements may lead to unauthorized charges on your bank account or credit cards. Your personal information could be used for other fraudulent activities. Moreover, the impact on your credit report could make it difficult to obtain future credit.

It is crucial to report any suspected fraudulent activity to the appropriate authorities, including your bank, credit bureaus, and law enforcement. Taking immediate action can help mitigate the potential damage.

Navigating the complexities of online financial transactions, particularly those involving pre-owned credit agreements found on platforms like Craigslist, demands caution and awareness. While the convenience of Craigslist can be appealing, potential risks associated with fraudulent offers and legal implications necessitate a thorough understanding of the process. By understanding the potential pitfalls and employing the preventative measures discussed, individuals can significantly reduce their risk of falling victim to scams and protect their financial well-being.

Remember, verifying the legitimacy of any offer and seeking professional advice when needed are essential steps in ensuring a safe and secure transaction.

Obtain a comprehensive document about the application of ulta green hillsterms of use that is effective.