Va disability pay dates for 2023terms of use – VA Disability Pay Dates 2023: Terms of Use – Understanding when you can expect your benefits is crucial for financial planning. This guide provides a comprehensive overview of the 2023 VA disability payment schedule, addressing factors influencing payment disbursement, variations in schedules for different benefit types, accessing payment information, legal aspects, and preparing for potential delays. We’ll explore how to manage your payments effectively and address common questions.

We will cover the typical payment cycle and frequency, providing a projected payment calendar for 2023. We’ll also delve into methods for accessing your payment information online, steps to set up direct deposit, and how to update your contact information for timely payments. Furthermore, we’ll discuss the impact of external factors, such as government shutdowns, and offer strategies for budgeting and managing your VA disability payments.

Accessing Payment Information

Accessing your VA disability payment information is straightforward and can be done through several convenient methods. Understanding these methods ensures you can monitor your payments and make necessary updates to your account information promptly. This section will Artikel the various ways to access your payment information and manage your direct deposit setup.

The primary method for accessing your VA disability payment information is through the eBenefits portal. eBenefits provides a secure online platform where veterans can view their payment history, download payment statements, and manage their direct deposit information. Other methods, such as contacting the VA directly via phone or mail, are also available but are generally less efficient than using the online portal.

Accessing Payment Information Through eBenefits

The eBenefits portal offers a comprehensive view of your VA disability compensation. To access your payment information, you will need your enrollment information. Once logged in, navigate to the section dedicated to your disability compensation. This section typically displays a summary of your current benefits, payment schedule, and a history of past payments. You can download statements for tax purposes or for your personal records.

The site also displays your current payment method and contact information, allowing you to update these details as needed.

Setting Up Direct Deposit for VA Disability Payments

Setting up direct deposit is a simple process that ensures your payments are deposited directly into your bank account, eliminating the need to wait for a paper check. This method offers convenience, security, and ensures faster access to your funds. To set up direct deposit, you will need your bank account information, including your account number and routing number.

This information can be entered securely through the eBenefits portal. The VA will verify the information and confirm the setup, usually within a few business days. Be sure to double-check all entered information to prevent delays or errors.

Updating Contact Information

Maintaining accurate contact information is crucial for ensuring the timely receipt of your VA disability payments. If your address or banking information changes, updating this information promptly through the eBenefits portal is essential. Failure to do so could result in delays or missed payments.

To update your contact information, log into your eBenefits account. Navigate to the section that allows you to edit your personal information. Carefully review and update your address, phone number, and email address. If you have changed banks, you will need to update your banking information as well, following the same steps Artikeld for setting up direct deposit.

After making the necessary changes, confirm the updates to ensure they are saved correctly. The VA will typically send a confirmation message once the update is processed. Regularly review your contact information within eBenefits to ensure accuracy.

Planning for VA Disability Payments: Va Disability Pay Dates For 2023terms Of Use

Receiving VA disability payments can significantly impact your financial well-being. Careful planning and management are crucial to ensure these benefits are used effectively to meet your needs and achieve your financial goals. This section provides guidance on budgeting, saving, investing, and accessing resources to help you navigate your finances.Effective budgeting and management of VA disability payments involves creating a realistic budget that accounts for all your expenses and income sources.

This process allows for informed financial decisions and helps prevent unexpected financial strain. Understanding your spending habits and prioritizing essential expenses are key components of successful budget management.

Budgeting and Expense Tracking

Developing a comprehensive budget requires identifying all monthly expenses, including housing, utilities, food, transportation, healthcare, and debt payments. Categorizing expenses helps visualize spending patterns and identify areas for potential savings. Numerous free budgeting apps and spreadsheets are available to assist in tracking expenses and creating a detailed budget. For example, a veteran might allocate a specific portion of their payment for rent, another for groceries, and so on, ensuring all essential needs are met before considering discretionary spending.

Regularly reviewing and adjusting the budget based on changing circumstances is essential for maintaining financial stability.

Saving and Investing Strategies, Va disability pay dates for 2023terms of use

Saving a portion of your VA disability payment is crucial for building financial security. Even small, consistent savings can accumulate over time. Consider setting up an automatic transfer from your checking account to a savings account each month. Investing a portion of your savings can help your money grow over the long term. Options include low-cost index funds, government bonds, and retirement accounts like a Roth IRA or traditional IRA.

A veteran might aim to save 10-20% of their monthly payment and gradually increase their investment contributions as their financial situation improves. Seeking professional financial advice can help determine the most suitable investment strategy based on individual circumstances and risk tolerance.

Available Financial Resources

Several resources are available to help veterans manage their finances. The Veterans Benefits Administration (VBA) website offers information on benefits and financial planning resources. Many veterans’ organizations, such as the Veterans of Foreign Wars (VFW) and the American Legion, provide financial counseling and educational programs. Local community organizations and non-profit groups also often offer free financial literacy workshops and one-on-one counseling.

The Department of Veterans Affairs also partners with various financial institutions to offer specialized financial products and services to veterans. Utilizing these resources can provide valuable support and guidance in navigating financial challenges and making informed decisions.

Successfully navigating the VA disability payment system requires understanding the intricacies of the schedule, accessing your payment information efficiently, and planning for potential delays. By utilizing the resources and strategies Artikeld in this guide, veterans can effectively manage their finances and ensure timely receipt of their well-deserved benefits. Remember to proactively monitor your account and contact the VA with any questions or concerns.

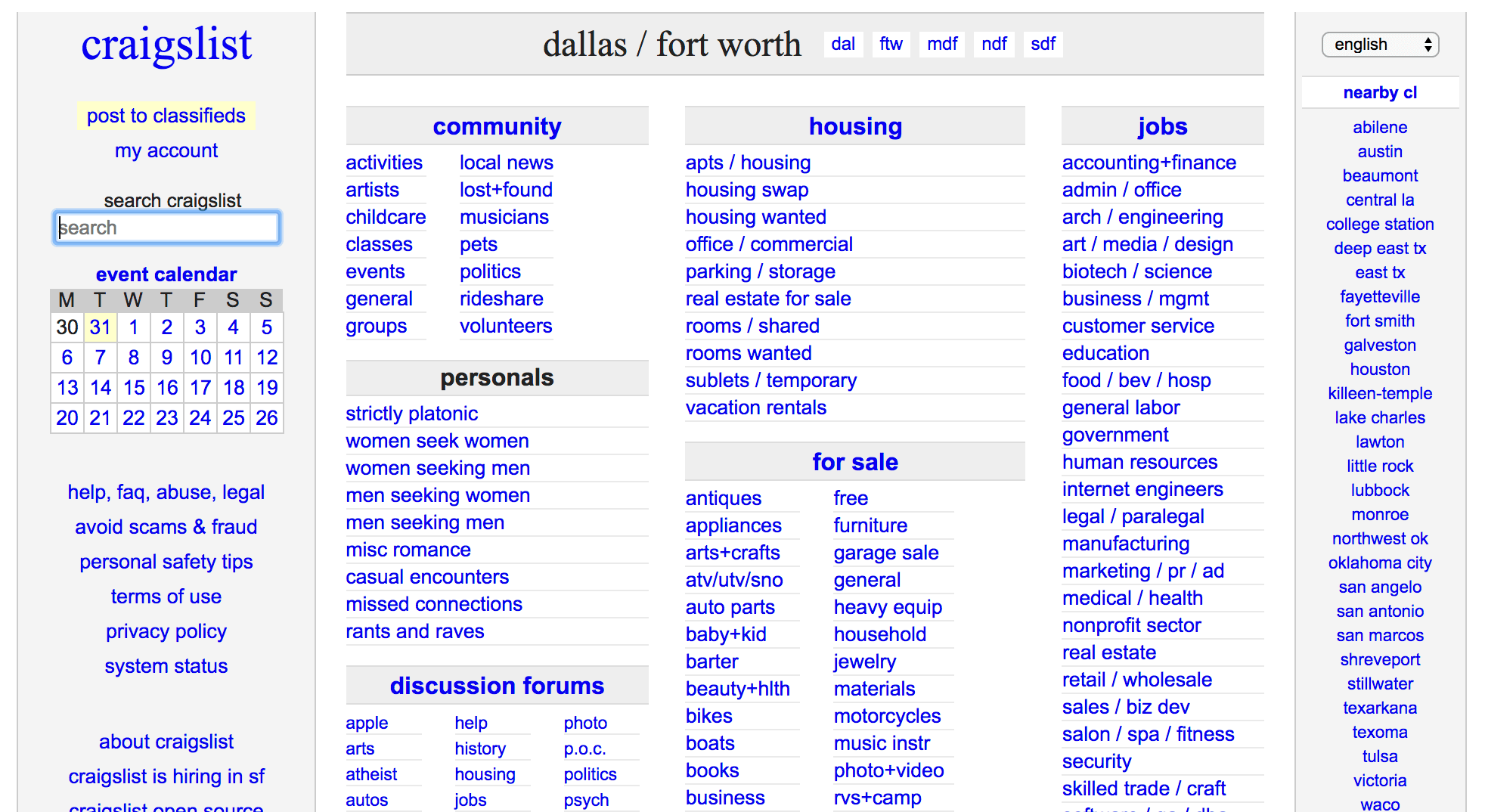

Get the entire information you require about glide bait templatedayton craigslist on this page.